# Clear the environment

rm(list=ls(all=TRUE))

# Set number of periods

Q=500

# Set number of scenarios (including baseline)

S=4

# Set period in which shock/shift will occur

s=20

# Create (S x Q)-matrices that will contain the simulated data

Y=matrix(data=1,nrow=S,ncol=Q) # Income/output

R=matrix(data=1,nrow=S,ncol=Q) # Rent

P=matrix(data=1,nrow=S,ncol=Q) # Profits

N=matrix(data=1,nrow=S,ncol=Q) # employment

w=matrix(data=1,nrow=S,ncol=Q) # real wage

K=matrix(data=1,nrow=S,ncol=Q) # capital stock

MPL=matrix(data=1,nrow=S,ncol=Q) # marginal product of labour

W=matrix(data=1,nrow=S,ncol=Q) # wage bill

N_eq=vector(length=S) # equilibrium population

K_eq=vector(length=S) # equilibrium capital

# Set baseline parameter values

A=matrix(data=2,nrow=S,ncol=Q) # productivity

a=matrix(data=0.7,nrow=S,ncol=Q) # labour elasticity of output

beta=1 # Sensitivity of investment with respect to profits

gamma=5 # adjustment speed of population

wS=matrix(data=0.5,nrow=S,ncol=Q) # subsistence wage rate

# Set parameter values for different scenarios

A[2,s:Q]=3 # scenario 2: productivity boost I

a[3,s:Q]=0.75 # scenario 3: productivity boost II

wS[4,s:Q]=0.6 # scenario 4: increase in subsistence wage

# Initialise variables such that employment and the capital stock are below the equilibrium

N[,1]=1

K[,1]=1

Y[,1]=A[,1]*N[,1]^(a[,1])

MPL[,1]=a[,1]*A[,1]*(N[,1]^(a[,1]-1))

w[,1]=wS[,1]

# Simulate the model by looping over Q time periods for S different scenarios

for (i in 1:S){

for (t in 2:Q){

for (iterations in 1:1000){ # run the model 1000-times in each period

#Model equations

#(1) Output

Y[i,t] = A[i,t]*N[i,t]^(a[i,t])

#(2) Wage bill

W[i,t] = K[i,t]

#(3) Real wage rate

w[i,t] = W[i,t]/N[i,t]

#(4) Marginal product of labour

MPL[i,t] = a[i,t]*A[i,t]*(N[i,t]^(a[i,t]-1))

#(5) Rents

R[i,t] = Y[i,t] - N[i,t]*MPL[i,t]

#(6) Profits

P[i,t] = Y[i,t]- R[i,t] - N[i,t]*w[i,t]

# (7) Capital accumulation

K[i,t] = K[i,t-1] + beta*P[i,t-1]

#(8) Employment/population dynamics

N[i,t] = N[i,t-1] + gamma*(w[i,t-1] - wS[i,t-1])

} # close iterations loop

} # close time loop

} # close scenario loop14 A Ricardian One-Sector Model

Overview

This model captures some key feature of David Ricardo’s theory of growth and distribution as developed in his 1817 book On the Principles of Political Economy and Taxation. The model revolves around the determination of real wages, rents, and profits, and how profitability in turn drives capital accumulation.1 It assumes a corn economy with a single good (corn) that serves both as an investment and consumption good.2 Corn production is subject to diminishing marginal returns. Real wages are driven down to a subsistence level and rent is a differential surplus landowners gain based on the fertility of their land relative to the marginal plot of land (the plot of land where fertility is lowest and no rent is earned). Profits are a residual. As employment increases and more land is utilised, marginal productivity falls and differential rents increase. As a result, profits are driven down and capital accumulation comes to a halt. A stationary state is reached. Landowners are the main beneficiaries of this process. The model is adapted from Pasinetti (1960).

The Model

The following equations describe the model:

\[ Y_t=AN_t^a \tag{14.1}\]

\[ W_t=K_t \tag{14.2}\]

\[ w_t =W_t/N_t \tag{14.3}\]

\[ MPL_t =\frac{\partial Y_t}{\partial N_t} =aAN_t^{a-1} \tag{14.4}\]

\[ R_t = Y_t - N_tMPL_t \tag{14.5}\]

\[ P_t = Y_t - R_t - N_tw_t \tag{14.6}\]

\[ K_t = K_{t-1} + \beta P_{t-1} \tag{14.7}\]

\[ N_t = N_{t-1} + \gamma (w_{t-1} - w^S) \tag{14.8}\]

where \(Y_t\), \(A\), \(N_t\), \(W_t\), \(K_t\),\(w_t\), \(Y_t\), \(MPL_t\), \(R_t\), \(P_t\), and \(w^S\) are real output (measured in units of corn), productivity, employment, the real wage bill (or wage fund), the capital stock, the real wage rate, the marginal product of labour, rents, profits, and the subsistence wage, respectively.

Equation 14.1 is the production function with \(\alpha \in (0,1)\), i.e. exhibiting diminishing marginal returns to labour.3 By Equation 14.2, the wage fund is defined as the capital stock of this model (reflecting the fact that the production of corn only involves labour). Equation 14.3 defines the real wage rate. Equation 14.3 specifies the marginal product of labour. Equation 14.5 captures the determination of (differential) rents as a negative function of the marginal product of labour.4 Thus, the lower the productivity on the marginal land, the higher the rents. In Equation 14.6, profits are determined residually. Capital accumulation in Equation 14.7 is driven by the reinvestment of profits (with \(\beta\) determining the proportion of profits that are reinvested). Finally, Equation 14.8 specifies population dynamics, whereby the population increases whenever the actual real wage is above the subsistence wage, echoing the Malthusian population mechanism.

Simulation

Parameterisation

Table 1 reports the parameterisation and initial values used in the simulation. In line with the Classical tradition, it will be assumed that all profits are reinvested, i.e. \(\beta=1\). Besides a baseline (labelled as scenario 1), three further scenarios will be considered. Scenarios 2 and 3 model two different forms of technological change: an increase in the productivity parameter \(A\) and an increase in the elasticity of output with respect to labour (\(a\)). Scenario 4 considers a higher subsistence wage (\(w^S\)). In all scenarios the population/employment is initialised below its equilibrium value.

Table 1: Parameterisation

| Scenario | \(A\) | \(a\) | \(w^S\) |

|---|---|---|---|

| 1: baseline | 2 | 0.7 | 0.5 |

| 2: productivity boost I (\(A\)) | 3 | 0.7 | 0.5 |

| 3: productivity boost II (\(a\)) | 2 | 0.75 | 0.5 |

| 4: higher subsistence wage (\(w^S\)) | 2 | 0.7 | 0.7 |

Simulation code

import numpy as np

# Set number of periods

Q = 500

# Set number of scenarios (including baseline)

S = 4

# Set period in which shock/shift will occur

s = 20

# Create (S x Q)-matrices that will contain the simulated data

Y = np.ones((S, Q)) # Income/output

R = np.ones((S, Q)) # Rent

P = np.ones((S, Q)) # Profits

N = np.ones((S, Q)) # employment

w = np.ones((S, Q)) # real wage

K = np.ones((S, Q)) # capital stock

MPL = np.ones((S, Q)) # marginal product of labour

W = np.ones((S, Q)) # wage bill

# Set baseline parameter values

A = np.ones((S, Q)) * 2 # productivity

a = np.ones((S, Q)) * 0.7 # labour elasticity of output

beta = 1 # Sensitivity of investment with respect to profits

gamma = 5 # adjustment speed of population

wS = np.ones((S, Q)) * 0.5 # subsistence wage rate

# Set parameter values for different scenarios

A[1, s:Q] = 3 # scenario 2: productivity boost I

a[2, s:Q] = 0.75 # scenario 3: productivity boost II

wS[3, s:Q] = 0.6 # scenario 4: increase in subsistence wage

# Initialise variables such that employment and the capital stock are below the equilibrium

N[:, 0] = 1

K[:, 0] = 1

Y[:, 0] = A[:, 0] * N[:, 0]**(a[:, 0])

MPL[:, 0] = a[:, 0] * A[:, 0] * (N[:, 0]**(a[:, 0] - 1))

w[:, 0] = wS[:, 0]

# Simulate the model by looping over Q time periods for S different scenarios

for i in range(S):

for t in range(1, Q):

for iterations in range(1000): # run the model 1000 times in each period

# Model equations

# (1) Output

Y[i, t] = A[i, t] * N[i, t]**(a[i, t])

# (2) Wage bill

W[i, t] = K[i, t]

# (3) Real wage rate

w[i, t] = W[i, t] / N[i, t]

# (4) Marginal product of labour

MPL[i, t] = a[i, t] * A[i, t] * (N[i, t]**(a[i, t] - 1))

# (5) Rents

R[i, t] = Y[i, t] - N[i, t] * MPL[i, t]

# (6) Profits

P[i, t] = Y[i, t] - R[i, t] - N[i, t] * w[i, t]

# (7) Capital accumulation

K[i, t] = K[i, t - 1] + beta * P[i, t - 1]

# (8) Employment/population dynamics

N[i, t] = N[i, t - 1] + gamma * (w[i, t - 1] - wS[i, t - 1])Plots

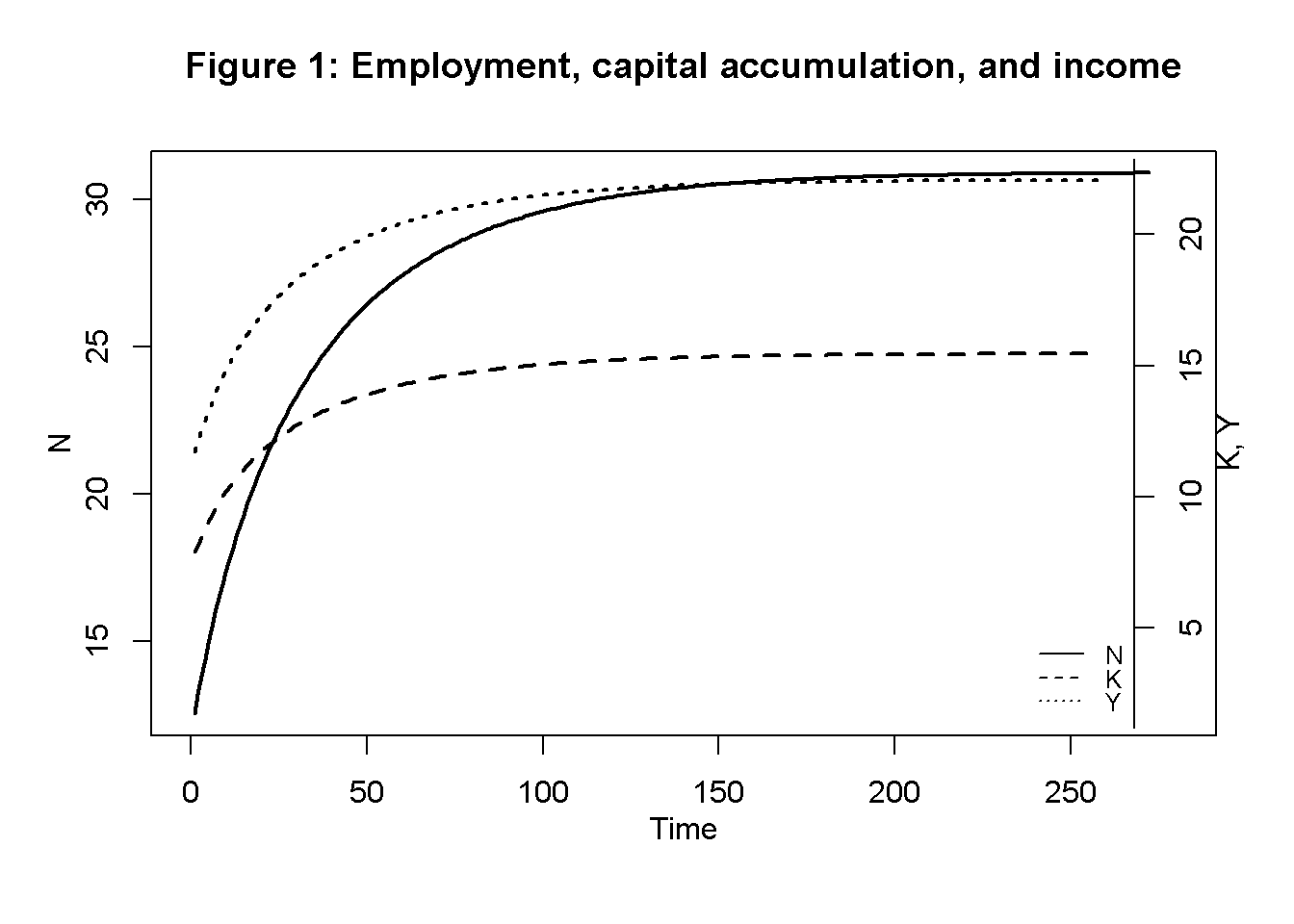

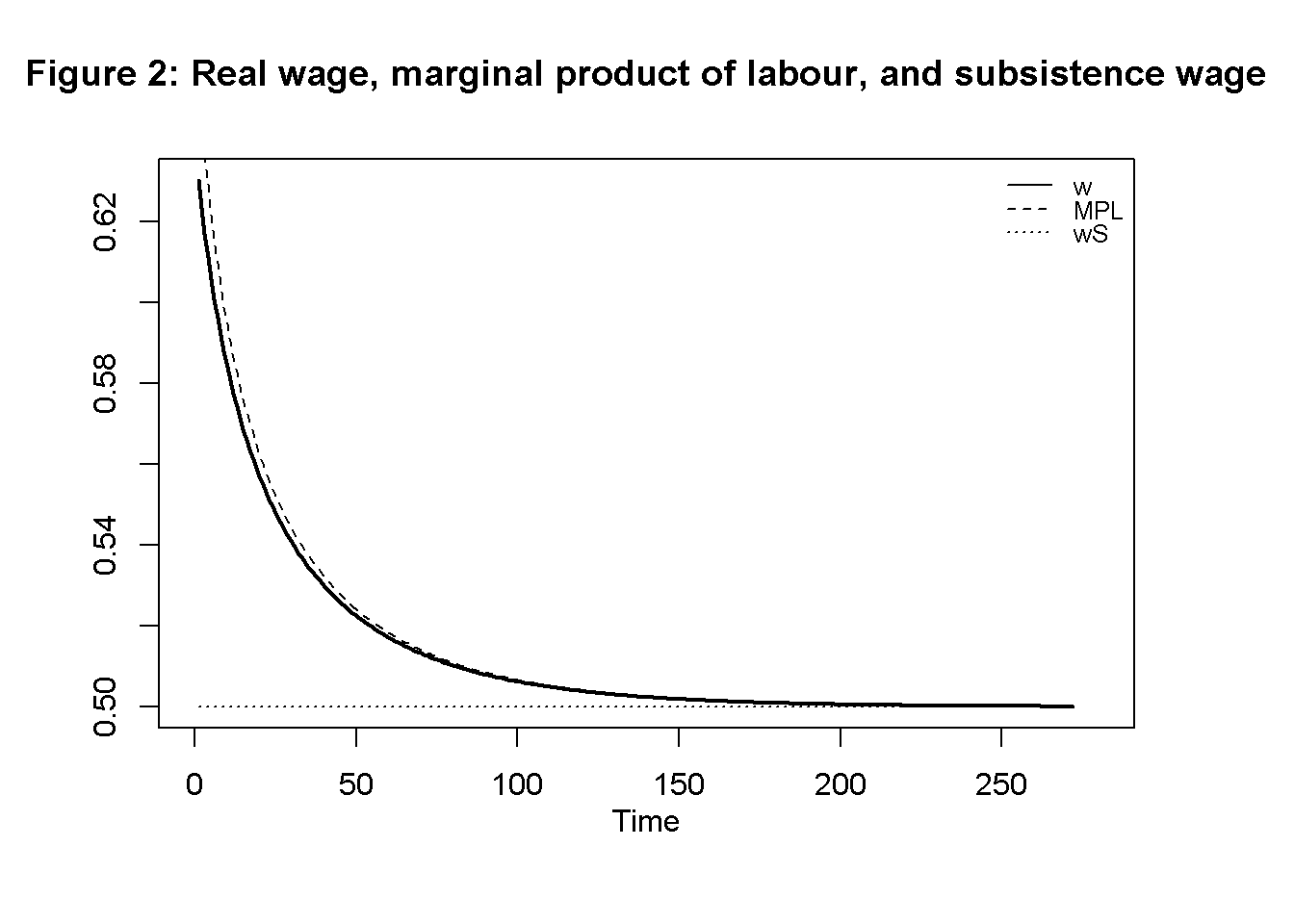

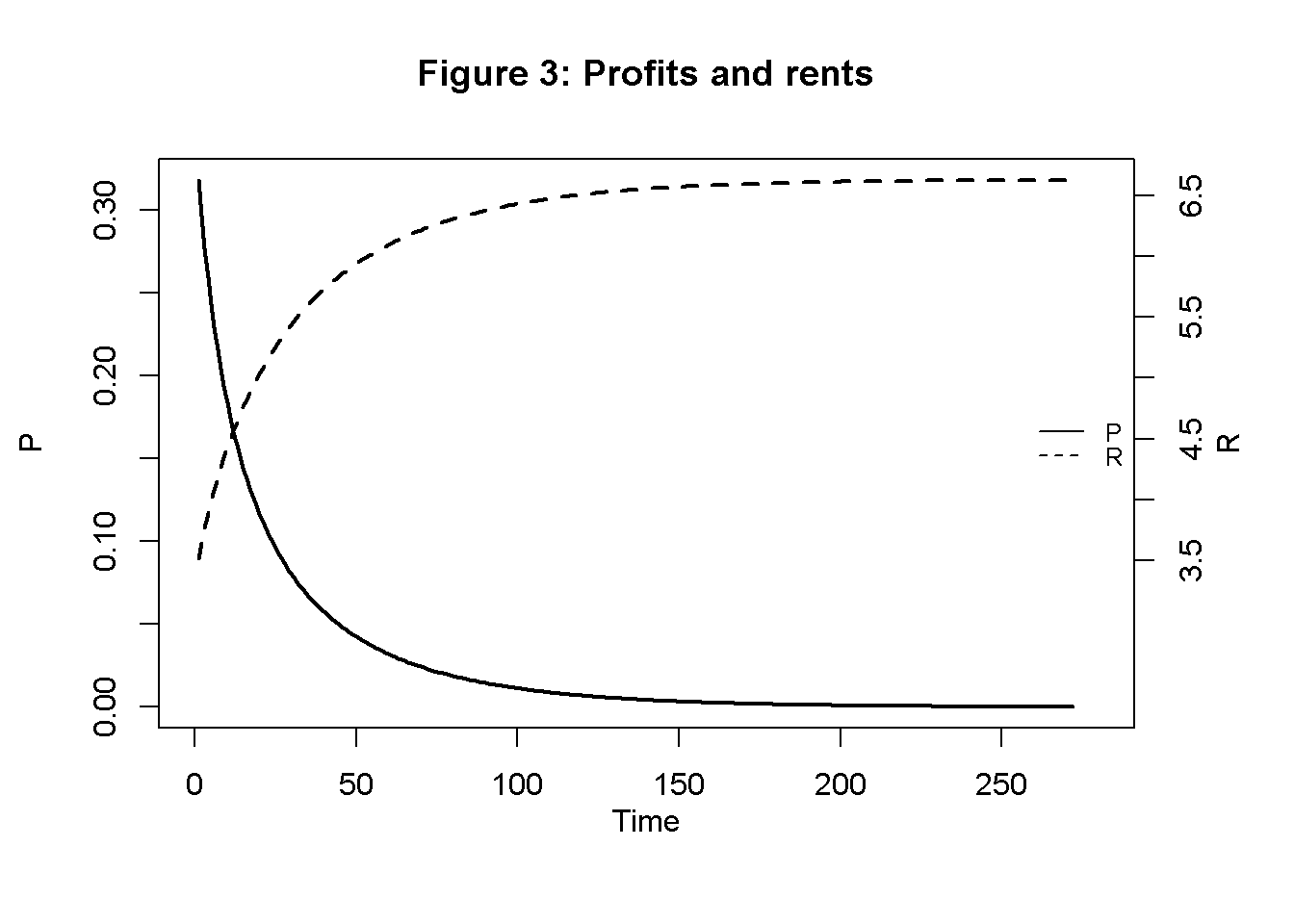

Figure 1 displays employment, capital accumulation, and income for the baseline scenario. Starting from a below-equilibrium level of population, the economy grows in terms of output, capital, and employment but then approaches what Ricardo famously called a ‘stationary state’. Figure 2 shows that during the adjustment phase, the MPL declines reflecting diminishing marginal returns in the production of corn. This captures the idea that a growing economy will have to utilise less fertile lands. The real wage is initially below the MPL, allowing for profits. Over time, the MPL and actual real wage converge to the exogenously given subsistence wage. Figure 3 shows that profits initially increase but are then squeezed to zero as differential rents increase.

# Set start and end periods for plots

Tmax=280

Tmin =10

## Baseline

#Employment, capital accumulation, and income

plot(N[1, Tmin:(Tmax+1)],type="l", lwd=2, lty=1, xlim=range(0:(Tmax)), ylab = '', xlab = '')

title(main="Figure 1: Employment, capital accumulation, and income",ylab = 'N', xlab = 'Time', cex=0.8, line=2)

par(mar = c(5, 4, 4, 4) + 0.3)

par(new = TRUE)

plot(K[1, Tmin:Tmax],type="l", col=1, lwd=2, lty=2, font.main=1,cex.main=1,ylab = '', axes=FALSE,

xlab = '',ylim = range(Y[1, 2:(Tmax+1)]),cex.axis=1,cex.lab=0.75)

lines(Y[1, Tmin:(Tmax+1)],lty=3, lwd=2)

axis(side = 4, at = pretty(range(Y[1, 2:(Tmax+1)])))

mtext("K, Y", side = 4, line = 2)

legend("bottomright", legend=c("N", "K", "Y"),

lty=1:3, cex=0.8, bty = "n", y.intersp=0.8)

# Real wage, subsistence wage, and MPL

plot(w[1, Tmin:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlim=range(0:(Tmax)), xlab="", ylab="", ylim=range(wS[1, Tmin:Tmax],w[1, Tmin:(Tmax)]))

title(main="Figure 2: Real wage, marginal product of labour, and subsistence wage", xlab = 'Time',cex=0.8,line=2)

lines(MPL[1, Tmin:Tmax],lty=2)

lines(wS[1, Tmin:Tmax],lty=3)

legend("topright", legend=c("w", "MPL", "wS"),

lty=1:3, cex=0.8, bty = "n", y.intersp=0.8)

# Profits and Rents

plot(P[1, Tmin:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlim=range(0:(Tmax)), xlab="", ylab="", ylim=range(P[1, Tmin:Tmax]))

title(main="Figure 3: Profits and rents", xlab = 'Time',cex=0.8,line=2)

par(mar = c(5, 4, 4, 4) + 0.3)

par(new = TRUE)

plot(R[1, Tmin:(Tmax+1)],type="l", col=1, lwd=2, lty=2, xlim=range(0:(Tmax)), xlab="", ylab="P",

ylim=range(R[1, 3:Tmax]), axes=FALSE)

axis(side = 4, at = pretty(range(R[1, Tmin:(Tmax+1)])))

mtext("R", side = 4, line = 2)

legend("right", legend=c("P", "R"), lty=1:2, cex=0.8, bty = "n", y.intersp=0.8)

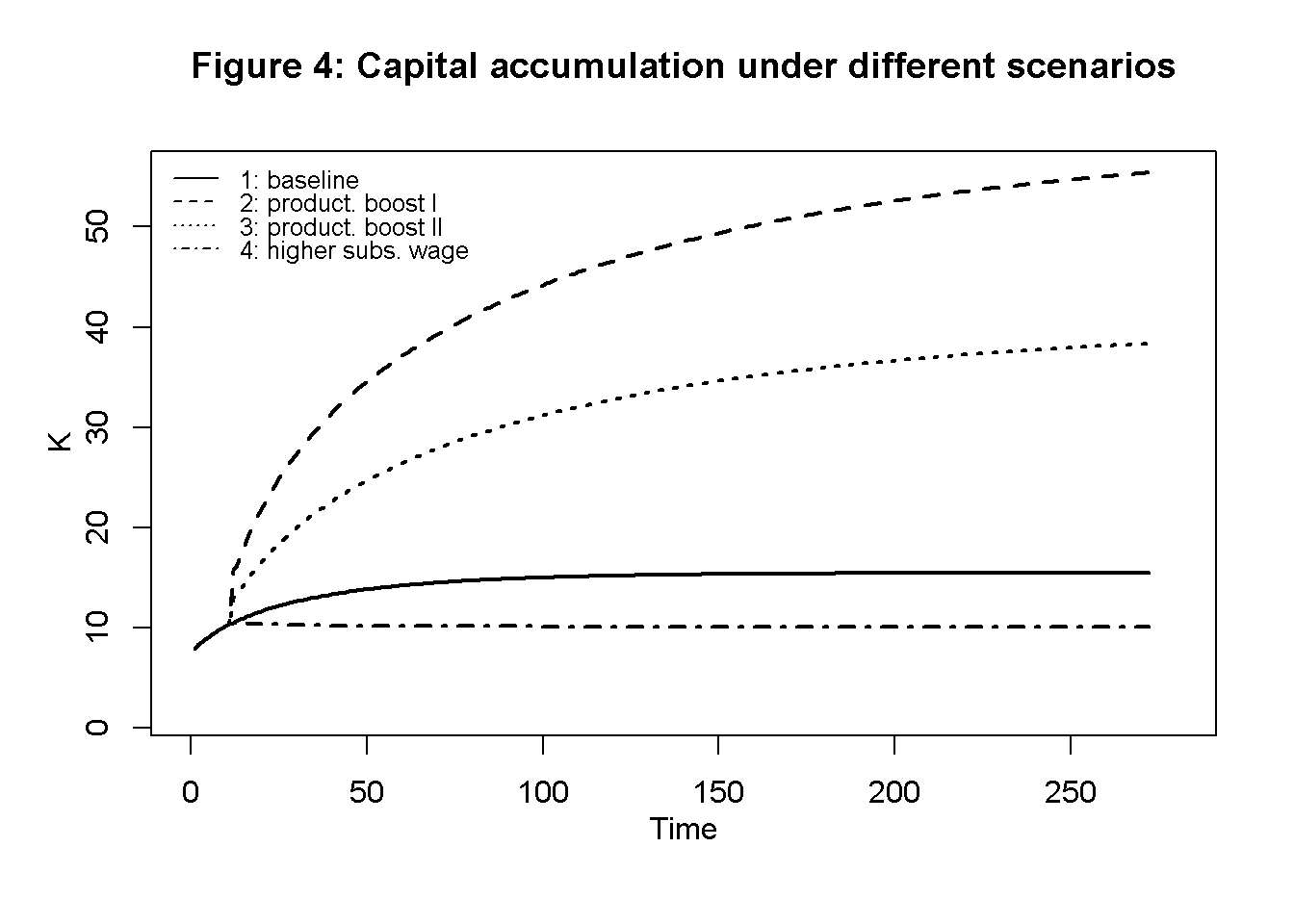

Figure 4 displays capital accumulation under the different scenarios described in Table 1. As expected, both forms of technical change boost both the speed of capital accumulation and the equilibrium level of capital. An increase in the subsistence wage reduces the pace of capital accumulation and leads to a lower equilibrium level of capital.

## Different scenarios

# Capital accumulation

plot(K[1, Tmin:(Tmax+1)],type="l", lwd=2, lty=1, xlim=range(0:(Tmax)), ylim=range(K[1, 2:Tmax], K[2, Tmin:Tmax]), ylab = '', xlab = '')

title(main="Figure 4: Capital accumulation under different scenarios",ylab = 'K', xlab = 'Time',cex=0.8, line=2)

lines(K[2, Tmin:(Tmax+1)],lty=2, lwd=2)

lines(K[3, Tmin:(Tmax+1)],lty=3, lwd=2)

lines(K[4, Tmin:(Tmax+1)],lty=4, lwd=2)

legend("topleft", legend=c("1: baseline","2: product. boost I", "3: product. boost II", "4: higher subs. wage"), lty=1:4, cex=0.8, bty = "n", y.intersp=0.8)

## Plots (here for employment, capital accumulation, and income only)

import matplotlib.pyplot as plt

# Set start and end periods for plots

Tmax = 280

Tmin = 10

# Baseline

# Employment, capital accumulation, and income

fig, ax1 = plt.subplots()

ax1.plot(N[0, 2:(Tmax+1)], linestyle='solid', label='N', linewidth=0.8, color="black")

ax1.set_xlabel('Time')

ax1.set_ylabel('N', rotation=0)

ax2 = ax1.twinx()

ax2.plot(K[0, 2:Tmax], linestyle='dashed', label='K', linewidth=0.8, color="black")

ax2.plot(Y[0, 2:Tmax], linestyle='dotted', label='Y', linewidth=0.8, color="black")

ax2.set_ylabel('Y, K', rotation=0)

lines, labels = ax1.get_legend_handles_labels() #collect legend in one box

lines2, labels2 = ax2.get_legend_handles_labels()

ax2.legend(lines + lines2, labels + labels2, loc=5)

plt.title("Figure 1: Employment, capital accumulation, and income")

plt.show()Directed graph

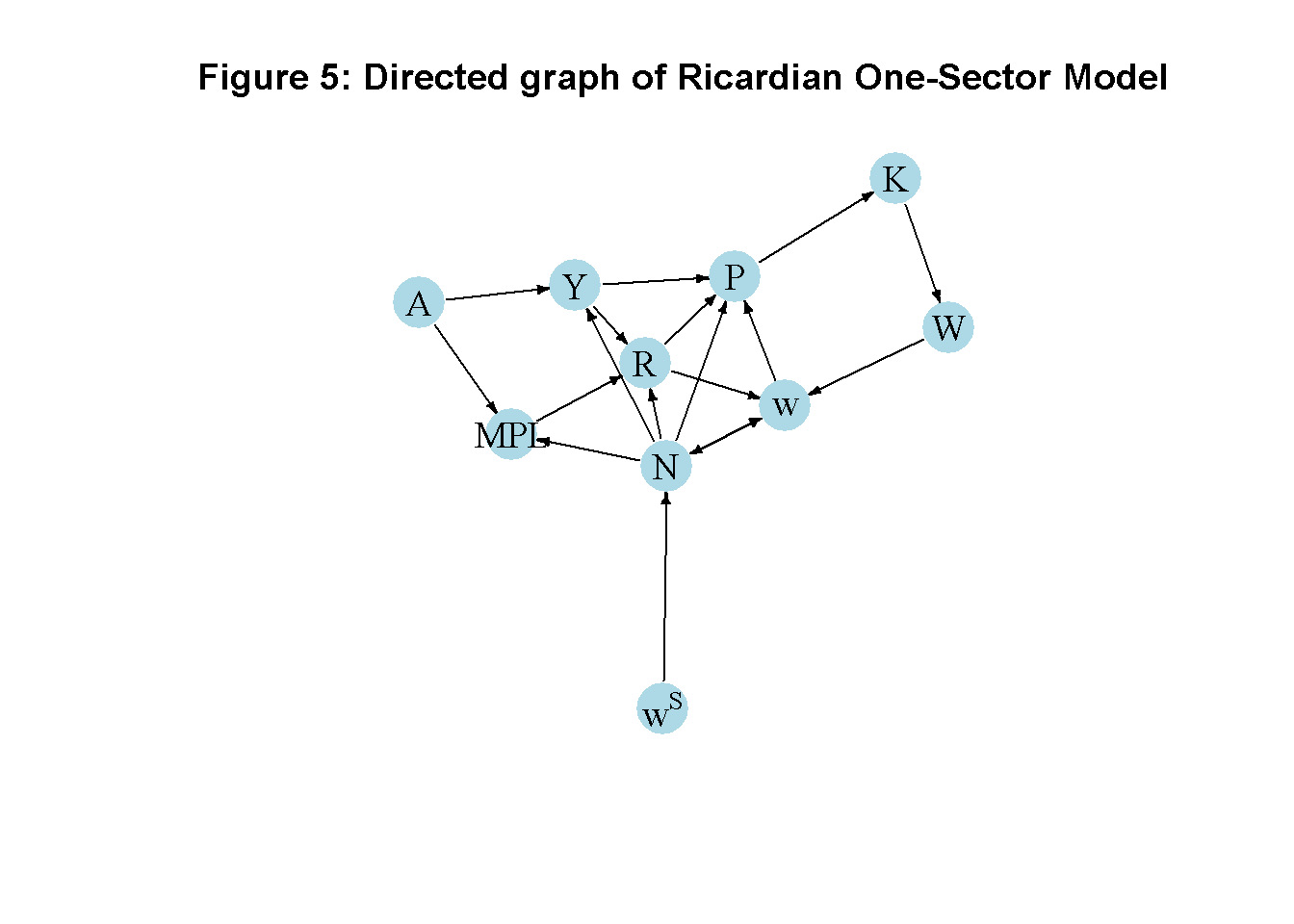

Another perspective on the model’s properties is provided by its directed graph. A directed graph consists of a set of nodes that represent the variables of the model. Nodes are connected by directed edges. An edge directed from a node \(x_1\) to node \(x_2\) indicates a causal impact of \(x_1\) on \(x_2\).

## Create directed graph

# Construct auxiliary Jacobian matrix for 10 variables: Y W w MPL R P K N A wS,

# where non-zero elements in regular Jacobian are set to 1 and zero elements are unchanged

M_mat=matrix(c(0,0,0,0,0,0,0,1,1,0,

0,0,0,0,0,0,1,0,0,0,

0,1,0,0,1,0,0,1,0,0,

0,0,0,0,0,0,0,1,1,0,

1,0,0,1,0,0,0,1,0,0,

1,0,1,0,1,0,0,1,0,0,

0,0,0,0,0,1,0,0,0,0,

0,0,1,0,0,0,0,0,0,1,

0,0,0,0,0,0,0,0,0,0,

0,0,0,0,0,0,0,0,0,0), 10,10, byrow=TRUE)

# Create adjacency matrix from transpose of auxiliary Jacobian and add column names

A_mat=t(M_mat)

# Create and plot directed graph from adjacency matrix

library(igraph)

dg= graph_from_adjacency_matrix(A_mat, mode="directed", weighted= NULL)

# Define node labels

V(dg)$name=c("Y", "W", "w", "MPL", "R", "P", "K", "N", "A", expression(w^S))

# Plot directed graph

plot(dg, main="Figure 5: Directed graph of Ricardian One-Sector Model", vertex.size=20, vertex.color="lightblue",

vertex.label.color="black", edge.arrow.size=0.3, edge.width=1.1, edge.size=1.2,

edge.arrow.width=1.2, edge.color="black", vertex.label.cex=1.2,

vertex.frame.color="NA", margin=-0.08)

# Create directed graph

import networkx as nx

# Construct auxiliary Jacobian matrix for 10 variables: Y W w MPL R P K N A wS,

# where non-zero elements in regular Jacobian are set to 1 and zero elements are unchanged

M_mat = np.array([

[0, 0, 0, 0, 0, 0, 0, 1, 1, 0],

[0, 0, 0, 0, 0, 0, 1, 0, 0, 0],

[0, 1, 0, 0, 1, 0, 0, 1, 0, 0],

[0, 0, 0, 0, 0, 0, 0, 1, 1, 0],

[1, 0, 0, 1, 0, 0, 0, 1, 0, 0],

[1, 0, 1, 0, 1, 0, 0, 1, 0, 0],

[0, 0, 0, 0, 0, 1, 0, 0, 0, 0],

[0, 0, 1, 0, 0, 0, 0, 0, 0, 1],

[0, 0, 0, 0, 0, 0, 0, 0, 0, 0],

[0, 0, 0, 0, 0, 0, 0, 0, 0, 0]

])

# Create adjacency matrix from transpose of auxiliary Jacobian and add column names

A_mat = M_mat.transpose()

# Create the graph from the adjacency matrix

G = nx.DiGraph(A_mat)

# Define node labels

nodelabs = {0: 'Y', 1: 'W', 2: 'w', 3: 'MPL', 4: 'R', 5: 'P', 6: 'K', 7: 'N', 8: 'A', 9: 'wS'}

# Plot the graph

pos = nx.spring_layout(G)

nx.draw_networkx(G, pos, node_size=500, node_color="lightblue",

edge_color="black", width=1.2, arrowsize=10,

arrowstyle='->', font_size=12, font_color="black",

with_labels=True, labels=nodelabs)

plt.axis("off")

plt.title("Figure 5: Directed graph of Ricardian One-Sector Model")

plt.show()In Figure 5, it can be seen that productivity (\(A\)) and the subsistence wage (\(w^S\)) are the key exogenous variables that impact income and the marginal product of labour, and population dynamics, respectively. Most other variables are endogenous and form a closed loop (or cycle) within the system. Profits are a residual. The directed graph illustrates the supply-driven nature of the model, where productivity determines employment and distribution, which in turn feed back into income and capital accumulation. At the same time, income distribution has an exogenous element in the form of the subsistence wage, which feeds into the system.

Analytical discussion

To analyse the dynamics, combine Equation 14.1 to Equation 14.6 and substitute into Equation 14.7. Further use Equation 14.2 and Equation 14.3 in Equation 14.8. This yields the two-dimensional dynamic system in \(K_t\) and \(N_t\):

\[ K_t = (1-\beta)K_{t-1}+\beta(aA N_{t-1}^a ) \] \[ N_t = N_{t-1} +\gamma\left(\frac{K_{t-1}}{N_{t-1}} -w^S\right) \] The Jacobian matrix is given by: \[ J(K, N)=\begin{bmatrix} 1-\beta& \beta a^2AN^{\alpha-1} \\\frac{\gamma}{N} & 1-\frac{\gamma K}{N^2} \end{bmatrix}. \]

From equations Equation 14.7 and Equation 14.8, it can readily be seen that an equilibrium is reached when \[ P^*=0 \] and \[ w^*=w^S. \] Using \(P^*=0\) with Equation 14.5 and Equation 14.6, yields \(w^*=w^S=MPL\). Thus, in equilibrium, profits are zero, and the real wage is equal to the MPL and the subsistence wage. Setting \(K_t=K_{t-1}\) and \(N_t=N_{t-1}\), we can further derive:

\[ K^*=aA\left(\frac{w^S}{aA}\right)^{-\frac{a}{1-a}} \] and

\[ N^*=\left(\frac{w^S}{aA}\right)^{-\frac{1}{1-a}} \] With this, we can evaluate the Jacobian at the steady state: \[ J(K^*, N^*)=\begin{bmatrix} 1-\beta & \beta a w^S \\ \gamma \left(\frac{w^S}{aA}\right)^{\frac{1}{1-a}} & 1-\gamma aA \left(\frac{w^S}{aA}\right)^{\frac{2-a}{1-a}} \end{bmatrix}. \] For the system to be stable, both eigenvalues of the Jacobian need to be inside the unit circle. This requires the following three conditions to hold:

\[ 1+tr(J)+det(J)>0 \] \[ 1-tr(J)+det(J)>0 \] \[ 1-det(J)>0, \] where \(tr(J)\) is the trace and \(det(J)\) is the determinant of the Jacobian.

Let us consider the Classical case where \(\beta=1\), i.e. all profits are reinvested. Then we have

\[ det(J)=-aw^S \gamma \left(\frac{w^S}{aA}\right)^{\frac{1}{1-a}}<0, \] so that the third condition is always satisfied and it is the first one that is binding. The first condition then becomes

\[ 2-\gamma a \left[ A \left(\frac{w^S}{aA}\right)^{\frac{2-a}{1-a}} + w^S\left(\frac{w^S}{aA}\right)^{\frac{1}{1-a}} \right]>0 \]

We can check the analytical solutions and stability conditions numerically:

# Calculate equilibrium solutions

for (i in 1:S){

N_eq[i]=(wS[i,Q]/(a[i,Q]*A[i,Q]))^(-1/(1-a[i,Q]))

K_eq[i]=a[i,Q]*A[i,Q]*(wS[i,Q]/(a[i,Q]*A[i,Q]))^(-a[i,Q]/(1-a[i,Q]))

}

# Compare with numerical solutions (here only for baseline)

N_eq[1][1] 30.94046N[1,Q][1] 30.94031K_eq[1][1] 15.47023K[1,Q][1] 15.47018### Examine model properties (here for the baseline scenario only)

# Construct Jacobian matrix at the equilibrium

J=matrix(c(1-beta, beta*a[1,Q]*wS[1,Q],

beta*(wS[1,Q]/(a[1,Q]*A[1,Q]))^(1/(1-a[1,Q])),

1-gamma*a[1,Q]*A[1,Q]*(wS[1,Q]/(a[1,Q]*A[1,Q]))^((2-a[1,Q])/(1-a[1,Q]))), 2, 2, byrow=TRUE)

# Obtain eigenvalues

ev=eigen(J)

(values = ev$values)[1] 0.93134557 -0.01214592# Obtain determinant and trace

det=det(J) # determinant

tr=sum(diag(J)) # trace

#Check general stability conditions

print(1+tr+det>0)[1] TRUEprint(1-tr+det>0)[1] TRUEprint(1-det>0)[1] TRUE# Check specific stability condition for the case beta=1

for (i in 1:S){

print(paste0("Scenario ", i, ":"))

print(2-gamma*a[i,Q]*(A[i,Q]*(wS[i,Q]/(a[i,Q]*A[i,Q]))^((2-a[i,Q])/(1-a[i,Q]))

+ wS[i,Q]*(wS[i,Q]/(a[i,Q]*A[i,Q]))^(1/(1-a[i,Q])))>0)

}[1] "Scenario 1:"

[1] TRUE

[1] "Scenario 2:"

[1] TRUE

[1] "Scenario 3:"

[1] TRUE

[1] "Scenario 4:"

[1] TRUE# Initialize arrays for equilibrium solutions

N_eq = np.zeros(S)

K_eq = np.zeros(S)

# Calculate equilibrium solutions

for i in range(S):

N_eq[i] = (wS[i, Q-1] / (a[i, Q-1] * A[i, Q-1])) ** (-1 / (1 - a[i, Q-1]))

K_eq[i] = a[i, Q-1] * A[i, Q-1] * (wS[i, Q-1] / (a[i, Q-1] * A[i, Q-1])) ** (-a[i, Q-1] / (1 - a[i, Q-1]))

# Compare with numerical solutions (here only for baseline)

N_eq[0]

N[0,Q-1]

# Construct Jacobian matrix at the equilibrium

J = np.array([

[1 - beta, beta * a[0, Q-1] * wS[0, Q-1]],

[beta * (wS[0, Q-1] / (a[0, Q-1] * A[0, Q-1])) ** (1 / (1 - a[0, Q-1])),

1 - gamma * a[0, Q-1] * A[0, Q-1] * (wS[0, Q-1] / (a[0, Q-1] * A[0, Q-1])) ** ((2 - a[0, Q-1]) / (1 - a[0, Q-1]))]

])

# Obtain eigenvalues

eigenvalues, eigenvectors = np.linalg.eig(J)

print(eigenvalues)

# Obtain determinant and trace

det = np.linalg.det(J)

tr = np.trace(J)

# Check general stability conditions

print(1+tr+det>0)

print(1-tr+det>0)

print(1-det>0)

# Check specific stability condition for the case beta=1

for i in range(S):

print(f"Scenario {i + 1}:")

print(2 - gamma * a[i, Q-1] * (

A[i, Q-1] * (wS[i, Q-1] / (a[i, Q-1] * A[i, Q-1])) ** ((2 - a[i, Q-1]) / (1 - a[i, Q-1])) +

wS[i, Q-1] * (wS[i, Q-1] / (a[i, Q-1] * A[i, Q-1])) ** (1 / (1 - a[i, Q-1]))

) > 0)References

See chapter 2 of Foley (2006) for an excellent introduction.↩︎

See Chapter 15 for a two-sector extension of the model.↩︎

Pasinetti (1960) specifies a generic function \(f(N_t)\) with \(f(0) \geq\) 0, \(f'(0) > w^*\), and \(f''(N_t) < 0\). Equation 14.1 satisfies these conditions.↩︎

Equation 14.5 is based on the definition of total rent as the sum of the net gains of the non-marginal landowners. See Pasinetti (1960) for a formal derivation.↩︎