#Clear the environment

rm(list=ls(all=TRUE))

# Set number of periods

Q=50

# Set number of scenarios

S=3

# Set period in which shock/shift will occur

s=5

# Create (S x Q)-matrices that will contain the simulated data

y=matrix(data=0,nrow=S,ncol=Q) # Income/output

p=matrix(data=0,nrow=S,ncol=Q) # Inflation rate

r=matrix(data=0,nrow=S,ncol=Q) # Policy rate

rs=matrix(data=0,nrow=S,ncol=Q) # Stabilising interest rate

# Set constant parameter values

a1=0.3 # Sensitivity of inflation with respect to output gap

a2=0.7 # Sensitivity of output with respect to interest rate

b=1 # Sensitivity of central bank to inflation gap

a3=(a1*(1/(b*a2) + a2))^(-1)

# Set parameter values for different scenarios

A=matrix(data=6,nrow=S,ncol=Q) # autonomous spending

pt=matrix(data=2,nrow=S,ncol=Q) # Inflation target

ye=matrix(data=5,nrow=S,ncol=Q) # Potential output

A[1,s:Q]=7 # scenario 1: AD boost

pt[2,s:Q]=3 # scenario 2: higher inflation target

ye[3,s:Q]=5.5 # scenario 3: higher potential output

# Initialise endogenous variables at equilibrium values

y[,1]=ye[,1]

p[,1]=pt[,1]

rs[,1]=(A[,1] - ye[,1])/a1

r[,1]=rs[,1]

# Simulate the model by looping over Q time periods for S different scenarios

for (i in 1:S){

for (t in 2:Q){

#(1) IS curve

y[i,t] = A[i,t] - a1*r[i,t-1]

#(2) Phillips Curve

p[i,t] = p[i,t-1] +a2*(y[i,t]-ye[i,t])

#(3) Stabilising interest rate

rs[i,t] = (A[i,t] - ye[i,t])/a1

#(4) Monetary policy rule, solved for r

r[i,t] = rs[i,t] + a3*(p[i,t]-pt[i,t])

} # close time loop

} # close scenarios loop10 A New Keynesian 3-Equation Model

Overview

New Keynesian dynamic general equilibrium models were developed in the 1990s and 2000s to guide monetary policy.1 They build on real business cycle models with rational expectations but introduce Keynesian frictions such as imperfect competition and nominal rigidities. While the structural forms of these models are typically complex as behavioural functions are derived from the intertemporal optimisation, the reduced-form of the benchmark models can be represented by three main equations: (i) an IS curve, (ii) a Phillips curve, (iii) and an interest rate rule.

The IS curve establishes a negative relationship between real income and the real interest rate. For a higher real interest rate, households will save more and thus consume less. The Phillips curve models inflation as a function of the output gap. A positive output gap (an economic expansion) leads to higher inflation. The monetary policy rule specifies how the central bank reacts to deviations of actual inflation from a politically determined inflation target.

The simplified version of the 3-equation model we consider here is directly taken from chapter 3 of Carlin and Soskice (2014).2 This is a short-run model in which prices are flexible but the capital stock is fixed. The focus is thus on goods market equilibrium rather than economic growth. In the Carlin-Soskice version, inflation expectations are assumed to be adaptive and the response of aggregate demand to a change in the interest rate is sluggish. This renders the model dynamic.3

The model

\[ y_t=A -a_1r_{t-1} \tag{10.1}\]

\[ \pi_t=\pi_{t-1}+a_2(y_t -y_e) \tag{10.2}\]

\[ r_s=\frac{(A - y_e)}{a_1} \tag{10.3}\]

\[ r_t = r_s + a_3(\pi_t-\pi^T) \tag{10.4}\]

where \(y\), \(A\), \(r\), \(\pi\), \(y_e\), \(r_s\), and \(\pi^T\) are real output, autonomous demand (times the multiplier), the real interest rate, inflation, equilibrium output, the stabilising real interest rate, and the inflation target, respectively.

Equation 10.1 is the IS curve or goods market equilibrium condition. Aggregate output adjusts to the level of aggregate demand, which is given by autonomous demand (times the multiplier) and a component that is negatively related to the (lagged) real interest rate via households’ saving (\(a_1>0\)). Equation 10.2 is the Phillips curve. It is assumed that inflation is driven by adaptive expectations (\(E[\pi_{t}]=\pi_{t-1}\)) and positively related to the output gap \((y_t-y_e)\), i.e. \(a_2>0\). By Equation 10.3, the stabilising real interest rate is that real interest rate that is consistent with equilibrium output (\(y_e=A -a_1r_s\)). Finally, the interest rate rule in Equation 10.4 specifies the real interest rate the central bank needs to set to minimise its loss function (see Section 10.6 below for a derivation). The parameter \(a_3\) is a composite one given by \(a_3 = \frac{1}{a_1(\frac{1}{a_2 b} + a_2)} >0\). Although the central bank only sets the nominal interest rate \(i = r + E[\pi_{t}]\) directly, the fact that expected inflation is predetermined in every period allows it to indirectly control the real interest rate.

Simulation

Parameterisation

Table 1 reports the parameterisation used in the simulation. For all parameterisations, the system is initialised at the equilibrium \((y^*,\pi^*,r^*)=(y_e,\pi^T, r_s)\). Three scenarios will then be considered. In scenario 1, there is an increase in autonomous aggregate demand (\(A\)). In scenario 2, the central bank sets a higher inflation target (\(\pi^T\)). Scenario 3 considers a rise in equilibrium output (\(y_e\)).

Table 1: Parameterisation

| Scenario | \(a_1\) | \(a_2\) | \(b\) | \(A\) | \(\pi^T\) | \(y_e\) |

|---|---|---|---|---|---|---|

| 1: rise in aggregate demand (\(A\)) | 0.3 | 0.7 | 1 | 7 | 2 | 5 |

| 2: higher inflation target (\(\pi^T\)) | 0.3 | 0.7 | 1 | 6 | 3 | 5 |

| 3: rise in equilibrium output (\(y_e\)) | 0.3 | 0.7 | 1 | 6 | 2 | 5.5 |

Simulation code

import numpy as np

# Set number of periods

Q = 50

# Set number of scenarios

S = 3

# Set period in which shock/shift will occur

s = 5

# Create (S x Q) arrays to store simulated data

y = np.zeros((S, Q)) # Income/output

p = np.zeros((S, Q)) # Inflation rate

r = np.zeros((S, Q)) # Policy rate

rs = np.zeros((S, Q)) # Stabilizing interest rate

# Set constant parameter values

a1 = 0.3 # Sensitivity of inflation with respect to output gap

a2 = 0.7 # Sensitivity of output with respect to interest rate

b = 1 # Sensitivity of the central bank to inflation gap

a3 = (a1 * (1 / (b * a2) + a2)) ** (-1)

# Set parameter values for different scenarios

A = np.full((S, Q), 6) # Autonomous spending

pt = np.full((S, Q), 2) # Inflation target

ye = np.full((S, Q), 5) # Potential output

A[0, s:Q] = 7 # Scenario 1: AD boost

pt[1, s:Q] = 3 # Scenario 2: Higher inflation target

ye[2, s:Q] = 5.5 # Scenario 3: Higher potential output

# Initialize endogenous variables at equilibrium values

y[:, 0] = ye[:, 0]

p[:, 0] = pt[:, 0]

rs[:, 0] = (A[:, 0] - ye[:, 0]) / a1

r[:, 0] = rs[:, 0]

# Simulate the model by looping over Q time periods for S different scenarios

for i in range(S):

for t in range(1, Q):

# (1) IS curve

y[i, t] = A[i, t] - a1 * r[i, t - 1]

# (2) Phillips Curve

p[i, t] = p[i, t - 1] + a2 * (y[i, t] - ye[i, t])

# (3) Stabilizing interest rate

rs[i, t] = (A[i, t] - ye[i, t]) / a1

# (4) Monetary policy rule, solved for r

r[i, t] = rs[i, t] + a3 * (p[i, t] - pt[i, t])Plots

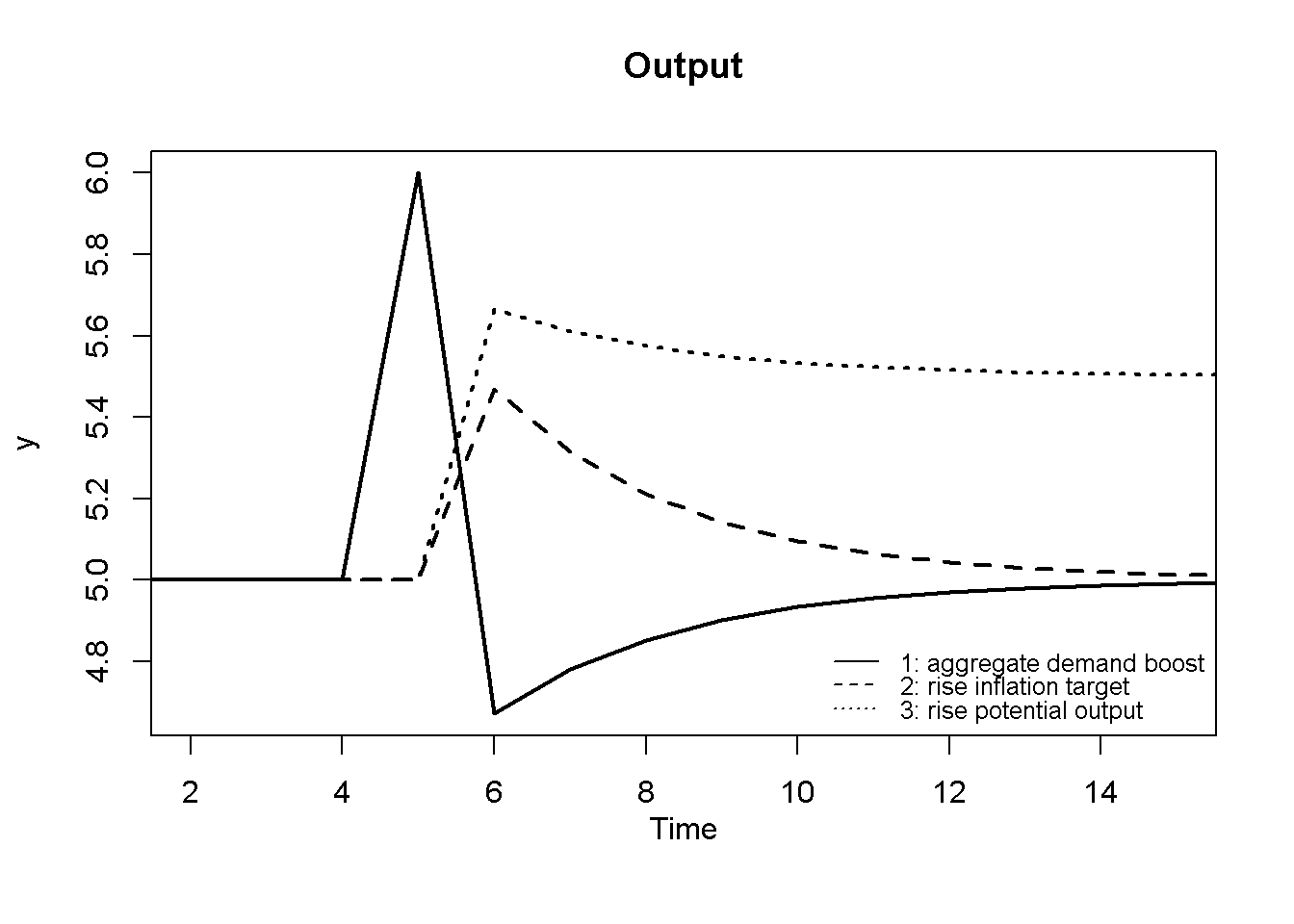

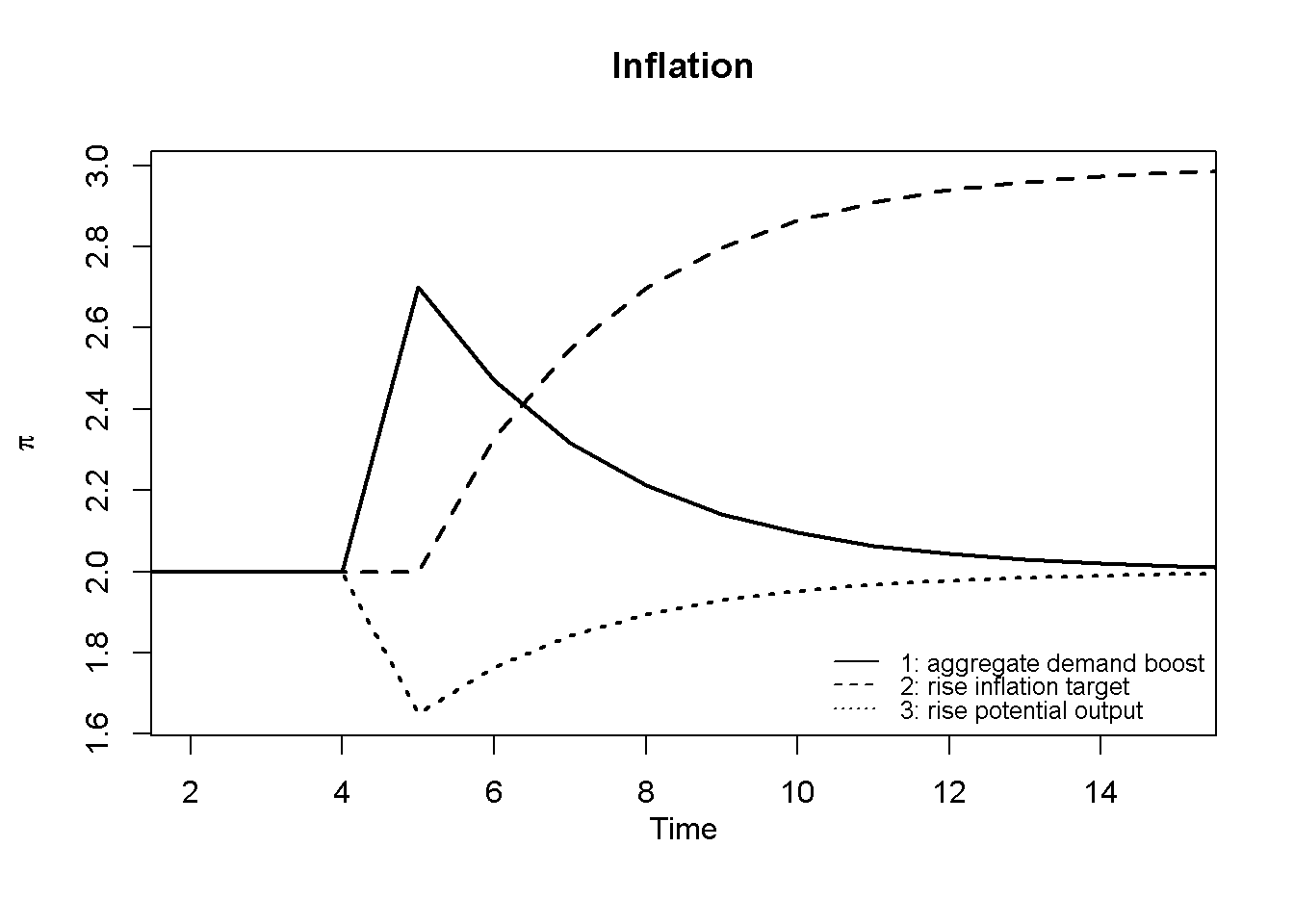

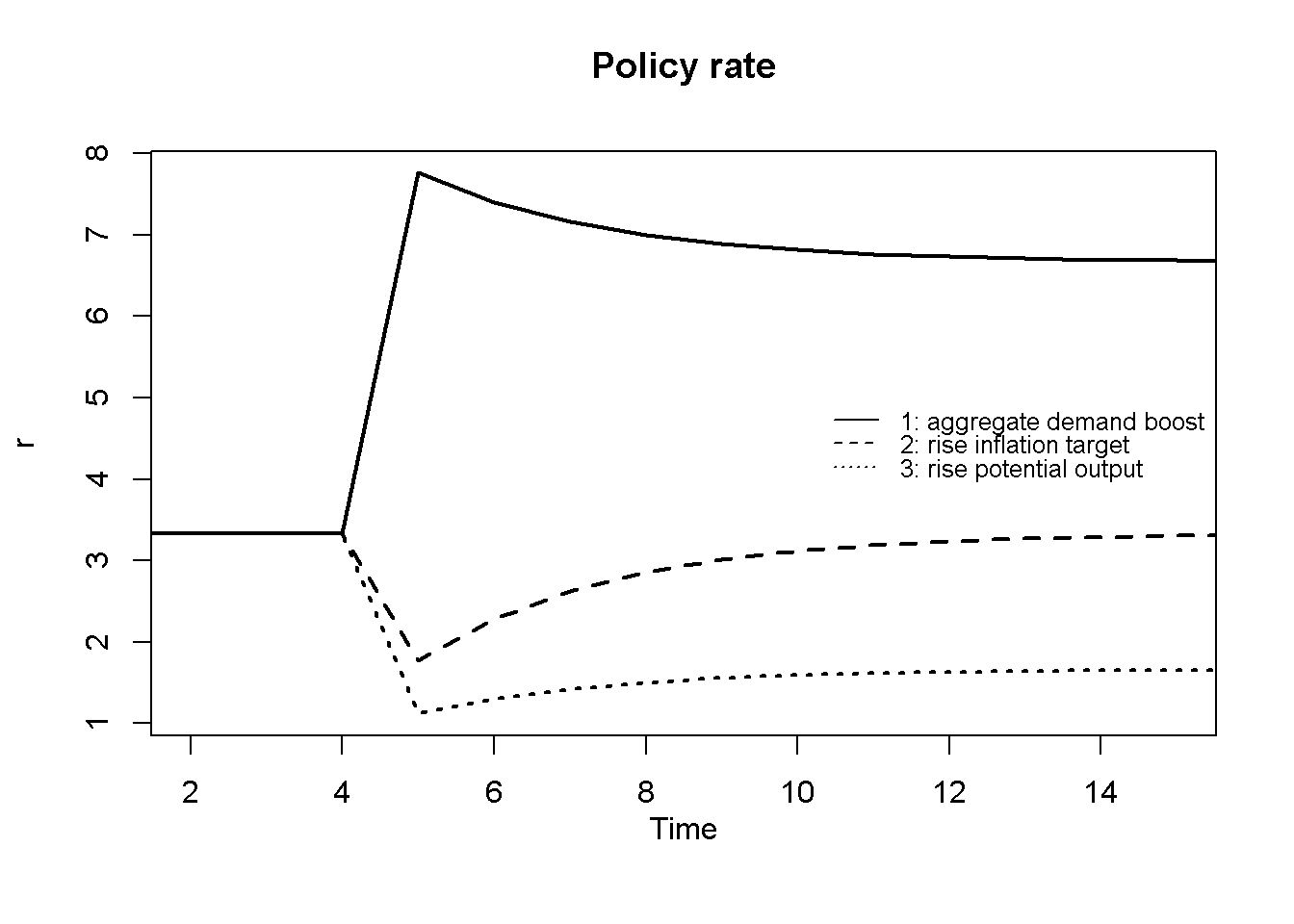

Figures Figure 10.1 - Figure 10.3 depict the response of the model’s key endogenous variables to various shifts. A permanent rise in aggregate demand (scenario 1) has an instantaneous expansionary effect on output, but also pushes inflation above the target. This induces the central bank to raise the interest rate, which brings down output below equilibrium in the next period. The central bank then gradually lowers the policy rate towards its new higher equilibrium value, where inflation is again stabilised at its target level.

### Plot results

# Set maximum period for plots

Tmax=15

# Output under different scenarios

plot(y[1, 1:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlab="", xlim=range(2:(Tmax)), ylab="y", ylim=range(y[1, 1:Tmax],y[3, 1:(Tmax)]))

title(main="Output", xlab = "Time",cex=0.8 ,line=2)

lines(y[2, 1:(Tmax+1)],lty=2, lwd=2)

lines(y[3, 1:(Tmax+1)],lty=3, lwd=2)

legend("bottomright", legend=c("1: aggregate demand boost", "2: rise inflation target", "3: rise potential output"), lty=1:3, cex=0.8, bty = "n", y.intersp=0.8)

# Inflation under different scenarios

plot(p[1, 1:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlab="", xlim=range(2:(Tmax)), ylab=expression(pi), ylim=range(p[, 2:Tmax]))

title(main="Inflation", xlab = "Time",cex=0.8 ,line=2)

lines(p[2, 1:(Tmax+1)],lty=2, lwd=2)

lines(p[3, 1:(Tmax+1)],lty=3, lwd=2)

legend("bottomright", legend=c("1: aggregate demand boost", "2: rise inflation target", "3: rise potential output"), lty=1:3, cex=0.8, bty = "n", y.intersp=0.8)

# Policy rate under different scenarios

plot(r[1, 1:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlab="", xlim=range(2:(Tmax)), ylab="r", ylim=range(r[, 2:Tmax]))

title(main="Policy rate", xlab = "Time",cex=0.8 ,line=2)

lines(r[2, 1:(Tmax+1)],lty=2, lwd=2)

lines(r[3, 1:(Tmax+1)],lty=3, lwd=2)

legend("right", legend=c("1: aggregate demand boost", "2: rise inflation target", "3: rise potential output"), lty=1:3, cex=0.8, bty = "n", y.intersp=0.8)

import matplotlib.pyplot as plt

# Set maximum period for plots

Tmax = 15

# Plot output under different scenarios

plt.figure(figsize=(8, 6))

plt.plot(y[0, :Tmax + 1], label="Scenario 1: aggregate demand boost",

color='k', linestyle='solid', linewidth=2)

plt.plot(y[1, :Tmax + 1], label="Scenario 2: Rise inflation target",

color='k', linestyle='dashed', linewidth=2)

plt.plot(y[2, :Tmax + 1], label="Scenario 3: Rise potential output",

color='k', linestyle='dotted', linewidth=2)

plt.title("Output under Different Scenarios")

plt.xlabel("Time")

plt.ylabel("y")

plt.xlim(1, Tmax)

plt.ylim(np.min(y), np.max(y))

plt.legend()

plt.show()An increase in the central bank’s inflation target (scenario 2) gradually raises the inflation rate to a new level. During the adjustment period, the interest rate falls, which temporarily allows for a higher level of output. However, there is no permanent expansionary effect.

By contrast, an increase in potential or equilibrium output (scenario 3) allows for a permanently higher level of output and a lower real interest rate.

Introducing rational inflation expectations

How do the predictions of the model change when assuming that private actors have rational instead of adaptive inflation expectations? The Phillips curve, Equation 10.2 of the model, assumes adaptive expectations: \(E[\pi_{t}]=\pi_{t-1}\). Following chapter 4 of Carlin and Soskice (2014), a (simplified) way of introducing rational inflation expectations is to assume \(E[\pi_{t}]=\pi^T\), i.e. rational agents know the central bank’s inflation target and assume that future inflation will (on average) be equal to the inflation target. The central bank will only be able to credibly commit to this target if it can deliver \(y_t=y_e\) in expectation. This, in turn, requires output to respond instantaneously to the interest rate, so that the IS curve becomes: \(y_t=A -a_1r_{t}\).4

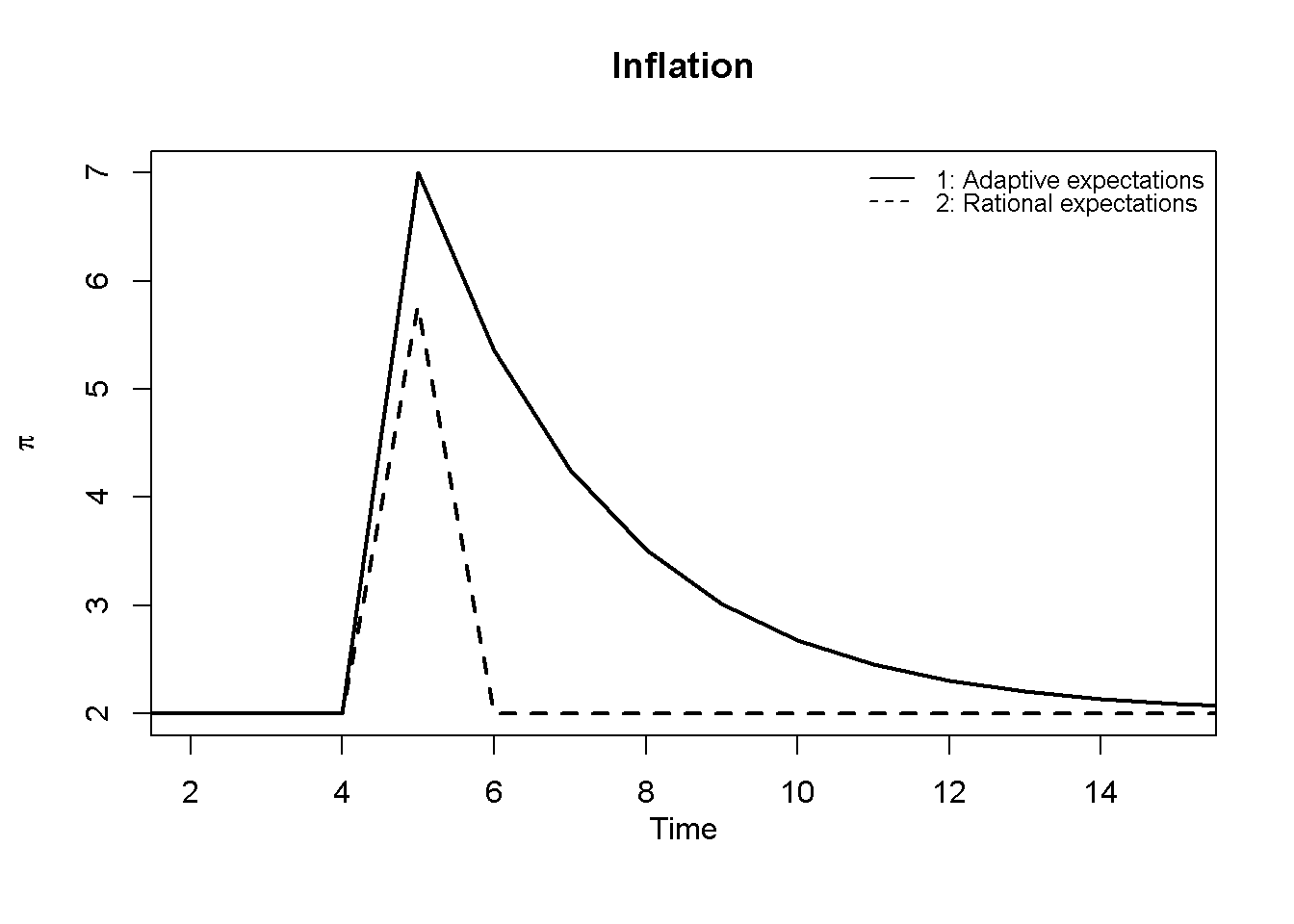

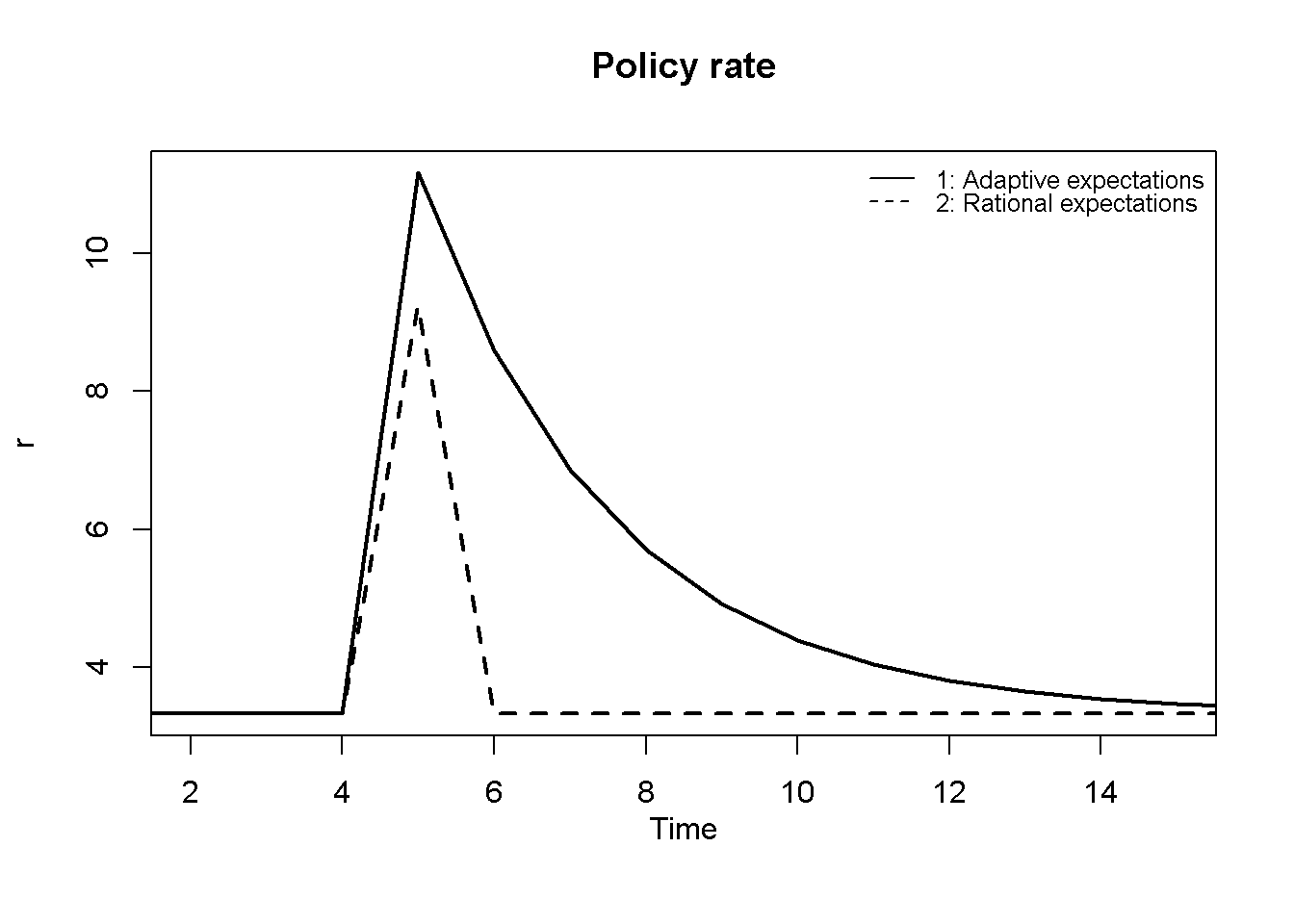

We simulate the model for both adaptive and rational inflation expectations to see how the economy reacts to a one-off 5-percentage point inflationary shock occurring in \(t=5\).

#Clear the environment

rm(list=ls(all=TRUE))

# Set number of periods

Q=50

# Set number of scenarios (here: comparison of adaptive and rational expectations)

S=2

# Set period in which shock/shift will occur

s=5

# Create (S x Q)-matrices that will contain the simulated data

y=matrix(data=0,nrow=S,ncol=Q) # Income/output

p=matrix(data=0,nrow=S,ncol=Q) # Inflation rate

r=matrix(data=0,nrow=S,ncol=Q) # Policy rate

# Set constant parameter values

a1=0.3 # Sensitivity of inflation with respect to output gap

a2=0.7 # Sensitivity of output with respect to interest rate

b=1 # Sensitivity of central bank to inflation gap

a3=(a1*(1/(b*a2) + a2))^(-1)

A=6 # autonomous spending

pt=2 # Inflation target

ye=5 # Potential output

rs=(A - ye)/a1 # Stabilising interest rate

# Initialise endogenous variables at equilibrium values

y[,1]=ye

p[,1]=pt

r[,1]=rs

# create a temporary inflation shock in period s

eps=matrix(data=0,nrow=S,ncol=Q) # inflation shock

eps[,s]=5

### Simulate adaptive expectations version of the model with an inflationary shock in t=s

# Use i=1 for adaptive expectations version

i=1

for (t in 2:Q){

# IS curve (with lagged interest rate)

y[i,t] = A - a1*r[i,t-1]

# Adaptive expectations Phillips Curve

p[i,t] = p[i,t-1] + a2 * (y[i,t] - ye) + eps[i,t]

# Monetary policy rule

r[i,t] = rs + a3*(p[i,t]-pt)

} # close time loop

### Simulate rational expectations version of the model with an inflationary shock in t=s

# Use i=2 for rational expectations version

i=2

for (t in 2:Q){

# Needs within-period iterations loop due to contemporaneous interest rate in the IS curve

for (iterations in 1:100){

# IS curve (with contemporaneous interest rate)

y[i,t] = A - a1*r[i,t]

# Rational expectations Phillips Curve

p[i,t] = pt + a2 * (y[i,t] - ye) + eps[i,t]

# Monetary policy rule

r[i,t] = rs + a3*(p[i,t]-pt)

} # close iterations loop

} # close time loop# Set maximum period for plots

Tmax = 15

# Inflation under adaptive vs rational expectations

plot(p[1, 1:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlab="", xlim=range(2:(Tmax)), ylab=expression(pi), ylim=range(p[, 2:Tmax]))

title(main="Inflation", xlab = "Time",cex=0.8 ,line=2)

lines(p[2, 1:(Tmax+1)],lty=2, lwd=2)

legend("topright", legend=c("1: Adaptive expectations", "2: Rational expectations"), lty=1:2, cex=0.8, bty = "n", y.intersp=0.8)

# Policy rate under adaptive vs rational expectations

plot(r[1, 1:(Tmax+1)],type="l", col=1, lwd=2, lty=1, xlab="", xlim=range(2:(Tmax)), ylab="r", ylim=range(r[, 2:Tmax]))

title(main="Policy rate", xlab = "Time",cex=0.8 ,line=2)

lines(r[2, 1:(Tmax+1)],lty=2, lwd=2)

legend("topright", legend=c("1: Adaptive expectations", "2: Rational expectations"), lty=1:2, cex=0.8, bty = "n", y.intersp=0.8)

# Set number of periods

Q = 50

# Set number of scenarios (here: comparison of adaptive and rational expectations)

S = 2

# Set period in which shock/shift will occur

s = 5

# Create (S x Q)-matrices that will contain the simulated data

y = np.zeros((S, Q)) # Income/output

p = np.zeros((S, Q)) # Inflation rate

r = np.zeros((S, Q)) # Policy rate

# Set constant parameter values

a1 = 0.3 # Sensitivity of inflation with respect to output gap

a2 = 0.7 # Sensitivity of output with respect to interest rate

b = 1 # Sensitivity of central bank to inflation gap

a3 = (a1 * (1 / (b * a2) + a2))**(-1)

A = 6 # Autonomous spending

pt = 2 # Inflation target

ye = 5 # Potential output

rs = (A - ye) / a1 # Stabilising interest rate

# Initialise endogenous variables at equilibrium values

y[:, 0] = ye

p[:, 0] = pt

r[:, 0] = rs

# Create a temporary inflation shock in period s

eps = np.zeros((S, Q)) # inflation shock

eps[:, s] = 5

# ----------------------------

# Simulate adaptive expectations version of the model with an inflationary shock in t=s

# Use i=0 for adaptive expectations version

# ----------------------------

i = 0

for t in range(1, Q): # Python is 0-based, so start at 1 for the 2nd period

# IS curve (with lagged interest rate)

y[i, t] = A - a1 * r[i, t-1]

# Adaptive expectations Phillips Curve

p[i, t] = p[i, t-1] + a2 * (y[i, t] - ye) + eps[i, t]

# Monetary policy rule

r[i, t] = rs + a3 * (p[i, t] - pt)

# ----------------------------

# Simulate rational expectations version of the model with an inflationary shock in t=s

# Use i=1 for rational expectations version

# ----------------------------

i = 1

for t in range(1, Q):

# Needs within-period iterations loop due to contemporaneous interest rate in the IS curve

for _ in range(100): # iteration loop

# IS curve (with contemporaneous interest rate)

y[i, t] = A - a1 * r[i, t]

# Rational expectations Phillips Curve

p[i, t] = pt + a2 * (y[i, t] - ye) + eps[i, t]

# Monetary policy rule

r[i, t] = rs + a3 * (p[i, t] - pt)

## Plot results

import matplotlib.pyplot as plt

# Set maximum period for plots

Tmax = 15

# Inflation under adaptive vs rational expectations

plt.figure(figsize=(7, 5))

# Adaptive expectations (i=0)

plt.plot(range(Tmax+1), p[0, 0:Tmax+1],

color="black", linewidth=2, linestyle="-", label="1: Adaptive expectations")

# Rational expectations (i=1)

plt.plot(range(Tmax+1), p[1, 0:Tmax+1],

color="black", linewidth=2, linestyle="--", label="2: Rational expectations")

# Titles and labels

plt.title("Inflation", fontsize=12)

plt.xlabel("Time", fontsize=10)

plt.ylabel(r"$\pi$", fontsize=12)

# Legend

plt.legend(loc="upper right", fontsize=9, frameon=False)

# Tight layout for nicer spacing

plt.tight_layout()

plt.show()

# Policy rate under adaptive vs rational expectations

plt.figure(figsize=(7, 5))

# Adaptive expectations (i=0)

plt.plot(range(Tmax+1), r[0, 0:Tmax+1],

color="black", linewidth=2, linestyle="-", label="1: Adaptive expectations")

# Rational expectations (i=1)

plt.plot(range(Tmax+1), r[1, 0:Tmax+1],

color="black", linewidth=2, linestyle="--", label="2: Rational expectations")

# Titles and labels

plt.title("Policy rate", fontsize=12)

plt.xlabel("Time", fontsize=10)

plt.ylabel("r", fontsize=12)

# Legend

plt.legend(loc="upper right", fontsize=9, frameon=False)

# Tight layout for nicer spacing

plt.tight_layout()

plt.show()It can be seen that under rational inflation expectations, the economy is less sensitive to shocks and returns to equilibrium much quicker. The job of the central bank is simpler: it only needs to raise the interest rate in the period the shock occurs to bring the economy back on target in the next period. Compared to adaptive expectations, a less drastic reponse is required.

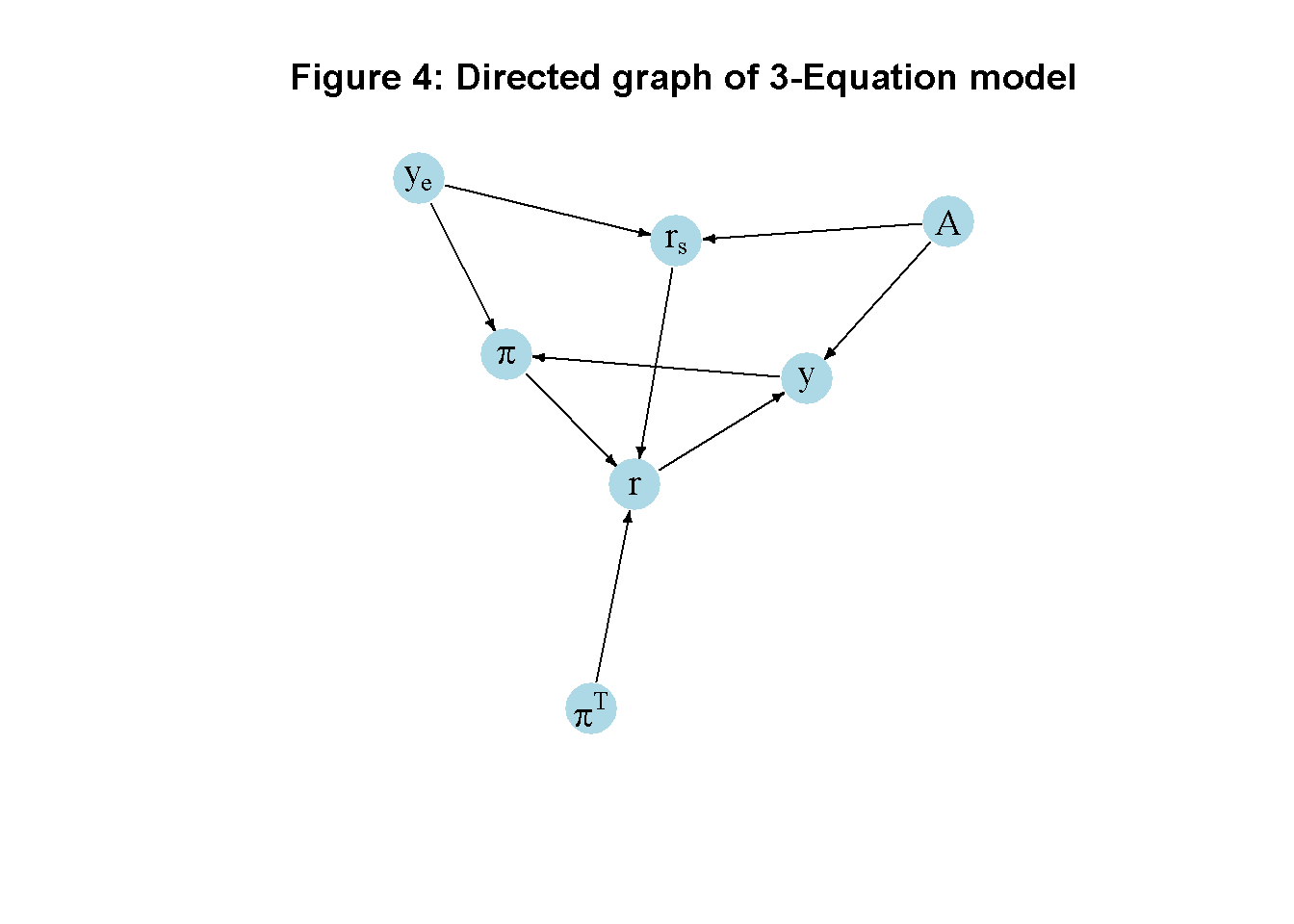

Directed graph

Another perspective on the model’s properties is provided by its directed graph. A directed graph consists of a set of nodes that represent the variables of the model. Nodes are connected by directed edges. An edge directed from a node \(x_1\) to node \(x_2\) indicates a causal impact of \(x_1\) on \(x_2\).

# Construct auxiliary Jacobian matrix for 7 variables: y, p, r, A, ye, rs, pt

# where non-zero elements in regular Jacobian are set to 1 and zero elements are unchanged

M_mat=matrix(c(0,0,1,1,0,0,0,

1,0,0,0,1,0,0,

0,1,0,0,0,1,1,

0,0,0,0,0,0,0,

0,0,0,0,0,0,0,

0,0,0,1,1,0,0,

0,0,0,0,0,0,0),7,7, byrow=TRUE)

# Create adjacency matrix from transpose of auxiliary Jacobian and add column names

A_mat=t(M_mat)

# Create directed graph from adjacency matrix

library(igraph)

dg=graph_from_adjacency_matrix(A_mat, mode="directed", weighted=NULL)

# Define node labels

V(dg)$name=c("y", expression(pi), "r", "A", expression(y[e]),expression(r[s]), expression(pi^T))

# Plot directed graph

plot(dg, main="Figure 4: Directed graph of 3-Equation model", vertex.size=20, vertex.color="lightblue",

vertex.label.color="black", edge.arrow.size=0.3, edge.width=1.1, edge.size=1.2,

edge.arrow.width=1.2, edge.color="black", vertex.label.cex=1.2,

vertex.frame.color="NA", margin=-0.08)

# Directed graph

import networkx as nx

import matplotlib.pyplot as plt

import numpy as np

# Define the Jacobian matrix

M_mat = np.array([[0, 0, 1, 1, 0, 0, 0],

[1, 0, 0, 0, 1, 0, 0],

[0, 1, 0, 0, 0, 1, 1],

[0, 0, 0, 0, 0, 0, 0],

[0, 0, 0, 0, 0, 0, 0],

[0, 0, 0, 1, 1, 0, 0],

[0, 0, 0, 0, 0, 0, 0],

])

# Create adjacency matrix from transpose of auxiliary Jacobian and add column names

A_mat = M_mat.transpose()

# Create the graph from the adjacency matrix

G = nx.DiGraph(A_mat)

# Define node labels

nodelabs = {

0: "y",

1: "π",

2: "r",

3: "A",

4: "yₑ",

5: "rₛ",

6: "πᵀ"

}

# Plot the directed graph

pos = nx.spring_layout(G, seed=43)

nx.draw(G, pos, with_labels=True, labels=nodelabs, node_size=300, node_color='lightblue',

font_size=10)

edge_labels = {(u, v): '' for u, v in G.edges}

nx.draw_networkx_edge_labels(G, pos, edge_labels=edge_labels, font_color='black')

plt.axis('off')

plt.show()In Figure 4, it can be seen that aggregate demand (\(A\)), equilibrium output (\(y_e\)), and the inflation target (\(\pi^T\)) are the key exogenous variables of the model. All other variables are endogenous and form a closed loop (or cycle) within the system. The upper-right side of the graph represents the supply side, given by the equilibrium level of output and its effect on inflation. The upper-left side captures the demand side and its effect on actual output. The key endogenous variables, output, inflation, and the interest rate form the centre of the graph, where they stand in a triangular relationship to each other. Output drives inflation, which in turn impacts the real interest rate. The latter then feeds back into output. Structural changes in the relationship between demand and supply (e.g. excess demand) also impact the system through their effect on the stabilising interest rate (\(r_s\)).

Analytical discussion

Derivation of core equations

IS curve

The IS curve in Equation 10.1 is loosely based on the consumption Euler equation introduced in Chapter 3. Suppose there are two periods and the household maximises its utility function \(U=\ln(C_t) + \beta \ln(C_{t+1})\) subject to the intertemporal budget constraint \(C_t+\frac{C_{t+1}}{1+r}=Y_t + \frac{Y_{t+1}}{1+r}\). Substituting the constraint into the objective function and differentiating with respect to \(C_t\) yields the first-order condition:

\[ C_t = \frac{C_{t+1}}{\beta(1+r)}. \]

This consumption Euler equation establishes the negative relationship between the real interest rate and expenditures in Equation 10.1.

PC curve

The Phillips curve Equation 10.2 is derived from wage- and price-setting in imperfect labour markets.5 Consider the following wage- and price-setting functions: \[ \frac{W}{P^E} = B + \alpha(y_t - y_e) + z_w \] \[ P=(1+\mu)\frac{W}{\lambda}, \tag{10.5}\]

i.e. the nominal wage \(W\), adjusted for the expected price level, is increasing in the output gap, a factor \(B\) capturing unemployment benefits and the disutility of work as well as a vector \(z_w\) of wage-push factors. Prices are set based on a constant mark-up (\(\mu\)) on unit labour cost (\(\frac{W}{\lambda}\)).

In equilibrium, the real wage is given by: \(w_e = B + z_w\). In a dynamic setting, wage setters will raise the expected real wage by \(\left(\frac{W_t}{P_{t}^E}\right) - \left(\frac{W_{t-1}}{P_{t-1}}\right)=\alpha(y_t - y_e)\). Together with adaptive expectations for prices \(\hat{P_t^E} = \hat{P}_{t-1}\) and the approximation \(\hat{W_t} - \hat{P_{t-1}} \approx \left(\frac{W_t}{P_{t}^E}\right) - \left(\frac{W_{t-1}}{P_{t-1}}\right)\), this yields the following equation for wage inflation: \[ \hat{W_t} = \hat{P}_{t-1} +\alpha(y_t - y_e). \tag{10.6}\]

Transforming equation Equation 10.5 into growth rates (\(\hat{P}=\hat{W}\)) and combining it with the wage-inflation equation Equation 10.6 yields the Phillips curve Equation 10.2.

Monetary policy rule

Finally, to derive the interest rate rule, start from the following central bank loss function:6

\[ L=(y_t-y_e)^2 + b(\pi_t - \pi^T)^2. \] Substituting the Phillips curve (Equation 10.2) into the loss function, differentiating with respect to \(y_t\), and simplifying yields the first-order condition:

\[ y_t-y_e = -a_2b(\pi_t-\pi^T), \]

which can also be regarded as a monetary policy rule. Next, substitute the Phillips curve (Equation 10.2), the IS-curve (Equation 10.1), and the stabilising interest rate (Equation 10.3) into the monetary policy rule and define \(a_3 = \frac{1}{a_1(\frac{1}{a_2b} + a_2)}\), which yields the interest rate rule (Equation 10.4).

Equilibrium solutions and stability analysis

By definition, in the steady state we have \(y^*=y_e\). This implies that \(r^*=r_s\). From this, it follows that \(\pi^* = \pi^T\).

To analyse the dynamic stability of the model, we rewrite it as a system of first-order difference equations. To this end, substitute Equation 10.1 into Equation 10.2, which yields: \[ \pi_t = \pi_{t-1} + a_2(A - a_1r_{t-1}-y_e) \tag{10.7}\]

Substitute this equation into Equation 10.4, which yields: \[ r_t= r_{s} + a_3[\pi_{t-1} + a_2(A - a_1r_{t-1}-y_e) - \pi^T]. \tag{10.8}\]

The Jacobian matrix of the system in Equation 10.1, Equation 10.7, and Equation 10.8 is given by: \[ J=\begin{bmatrix} 0& 0 &-a_1 \\0 & 1 & -a_1 a_2 \\ 0 & a_3 & -a_1 a_2 a_3 \end{bmatrix}. \] The eigenvalues of the Jacobian can be obtained from the characteristic polynomial \(\lambda^3 - Tr(J)\lambda^2 + [Det(J_1) + Det(J_2) + Det(J_3)]\lambda - Det(J) = 0\), where \(Tr(J)\) and \(Det(J\)) are the trace and determinant, respectively, and \(Det(J_i)\) refers to the \(i_{th}\) principal minor of the matrix. As there is a column in the Jacobian that only contains zeros, it follows that the matrix is singular and will have a zero determinant. In addition, all principal minors turn out to be zero. The characteristic polynomial thus reduces to \(\lambda^2[\lambda - Tr(J)]=0\). From this, it is immediate that \(\lambda_{1,2}=0\) and \(\lambda_{3}=Tr(J)\), where \(Tr(J)=1-a_1a_2a_3=\frac{1}{1+a_2^2b}\). Stability requires the single real eigenvalue to be smaller than unity (in absolute terms). With \(\lambda_3=\frac{1}{1+a_2^2b}\), stability thus only requires \(a_2 \neq 0\) and \(b>0\), i.e. the output gap needs to impact inflation (otherwise the key channel through which interest rate policy brings inflation back on target is blocked) and the central bank needs to assign a (non-negative) loss to deviations of actual inflation from its target.7

We can verify these analytical solutions by comparing them with the results from the numerical solution:

# Construct Jacobian matrix

J=matrix(c(0,0,-a1,

0,1,-a1*a2,

0,a3,-a1*a2*a3), 3, 3, byrow=TRUE)

# Obtain eigenvalues

ev=eigen(J)

(values <- ev$values)[1] 0.6711409 0.0000000 0.0000000# Obtain determinant and trace

det(J) # determinant[1] 0[1] 0.6711409import numpy as np

# Construct Jacobian matrix

J = np.array([[0, 0, -a1],

[0, 1, -a1 * a2],

[0, a3, -a1 * a2 * a3],])

# Calculate eigenvalues

eigenvalues = np.linalg.eigvals(J)

# Print the resulting eigenvalues

print(eigenvalues)

# Calculate the determinant and trace of the Jacobian matrix

determinant = np.linalg.det(J)

trace = np.trace(J)

print(determinant)

print(trace)References

A PDF version of the most 2024 edition of the book is freely available here.↩︎

Note that this is quite different from conventional New Keynesian dynamic stochastic general equilibrium (DSGE) models in which the dynamic element stems from agents with rational expectations that react to serially correlated shocks. See chapter 16 of Carlin and Soskice (2014) for a comparison of their 3-equation model with New Keynesian DSGE models.]↩︎

The IS curve in the Carlin-Soskice version of the 3-equation model is only loosely based on intertemporal optimisation (see analytical discussion section below). A rigorously derived IS-curve in a New Keynesian model with forward-looking expectations would contain the future expected output gap and expected inflation, see Galí (2018).↩︎

As mentioned in footnote 2, this property of the Carlin-Soskice model is very different from conventional New Keynesian models with rational expectations. In these models, variables such as output and inflation are driven by the ‘forward-looking’ behaviour of rational agents, i.e. they depend on expectational terms for their current values rather than lagged values. To ensure what is called ‘determinancy’, these forward-looking variables must adjust fast (or ‘jump’) to bring the economy back onto a path that is consistent with the optimising equilibrium. This requires the number of jump variables to be matched by an equal number of unstable roots (i.e. being outside the unit circle).↩︎